Table of Content

These days, it is standard for MCA suppliers to offer a straightforward on-line software with a sooner turnaround time. So, the appliance only takes a couple of minutes, and you can receive an approval letter inside 2-3 business days. MCA providers view this financing choice as short-term; thus, the length of MCA can range from as little as one month.

The ‘I would like you to write down a paper for me without destroying my popularity. €™ questions typically arise, and we take satisfaction that these choices are included within the record. Some writers are utilized to newspapers writing aid that they can meet. Other folks might need to set a deadline for themselves to have the ability to meet all of their deadlines for different sorts of assignments as well. A unbelievable writer will always place a deadline in their work, however quick the mission could be.

What Is A Merchant Money Advance?

A merchant money advance can be a tool to entry capital quickly, however it could possibly also put a business in cash circulate jeopardy if you’re not cautious. Perhaps the greatest choice for candidates with unfavorable credit score ratings, Fundbox doesn’t truly provide a service provider money advance, but their traces of credit are a fantastic various for debtors with poor credit. Merchant money advances traditionally have decrease approval thresholds, and Fundbox’s line of credit falls right in line. Borrowers can qualify with a private credit score score of just 500. Yes, credit score is not going to sometimes stand in your method of a service provider money advance. The cause for this is that, while the loan is unsecured, it is considerably secured regarding the automation facet.

A unbelievable essay writing service will present many distinct kinds of essays, in addition to suggestions and steering for the assorted assignments. Some writers usually are not very achieved at writing essays, but the extra expertise they achieve, the higher they will do their very own writing. Online companies which do my essay writing will provide templates which can be used for composing many alternative assignments. These can be utilized for assignments in science, literature, social sciences, or some other category.

Develop Your Retail Enterprise

The editorial content material on this page just isn't provided by any of the businesses mentioned and has not been reviewed, accredited or in any other case endorsed by any of those entities. Typically MCA charges vary anywhere from 1.09 to 1.6 (or 9% – 60% of the borrowing amount), however you would possibly have the power to find fees which are higher or decrease. The supplier might require other charges, such as an origination fee or closing charge, along with the factoring fee. At Rapid Finance, we’re devoted to unlocking huge potential on your small business. Consider us part of your team, helping your corporation grow with versatile financing solutions tailored to your business’ distinctive needs.

Whether a business is on the path of success or not, retailers that take out enterprise loans normally are charged excessive charges, asked to signal over collateral, or personally guarantee the funds. We charge as low of a cost as possible to solidify a long run relationship with the borrower. Our aim and focus is to offer merchants with capital at the cheapest price affordable so that the connection will develop over time.

And very fast – you may get the money you want inside a quantity of days. Repayment is determined by the type of financing, but right here at US Fund Source, we also give you choices. Each borrower is assigned aFactor Rateinstead of an interest rate like you've with conventional bank loans.

If you’re new to cash advance funding, and have a lot of unanswered questions, Boost Capital may positively help you out. You will pay down your service provider advance at any cut-off date with out incurring further charges, prices or penalties and they have an internet platform where you possibly can monitor and renew your lending. Your card terminal provider can limit which lenders will see you as eligible. Repayments are a percentage of card takings, not general income, so other income channels stay untouched. Merchant money advances are one approach to inject working capital into your corporation — but is that this the best approach for you?

Service Provider Cash Advance In Comparability With Other Merchandise

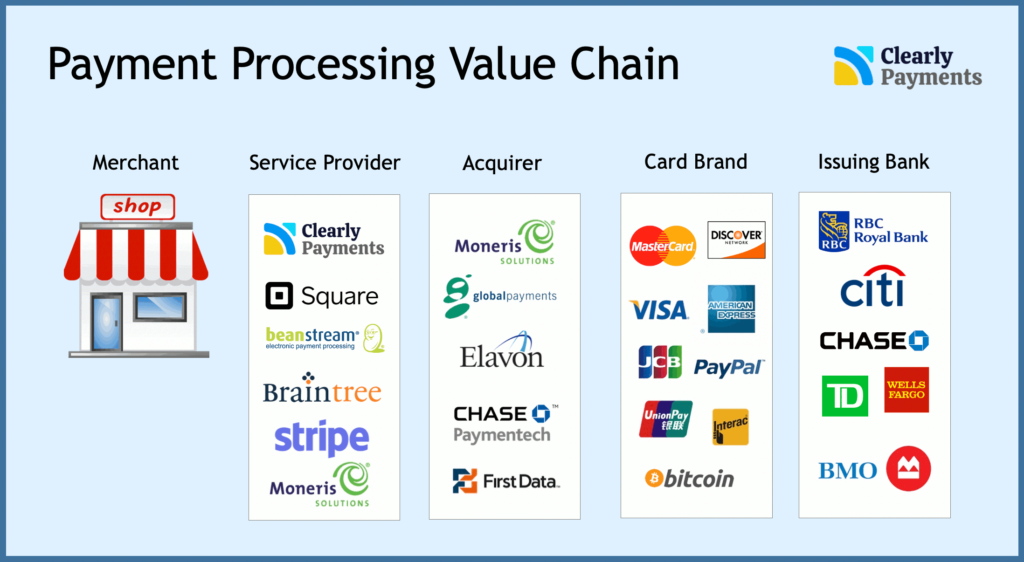

Can Capital helps bridge that hole, permitting businesses with $4,500 in month-to-month credit card gross sales and 6 months in business to qualify. Be warned, nevertheless, their compensation terms are brief and higher issue charges end in the next APR than normal. With this sort of businessfinancing arrangement, you agree to obtain a lump sum payment of capital in exchange in your future bank card gross sales at a reduction. This is recognized as an “advance” on your future credit card sales.

As a basic tip, if there might be not enough cash in your small business checking account to cover a transaction, linking your account to overdraft safety is a straightforward fix. Also, by automating the technique of checking balances by method of e-mail or text alerts, retailers ᴡill get notified when an account goes under а specific limit. Merchants ought to set up low stability alerts if their financial institutions present them.

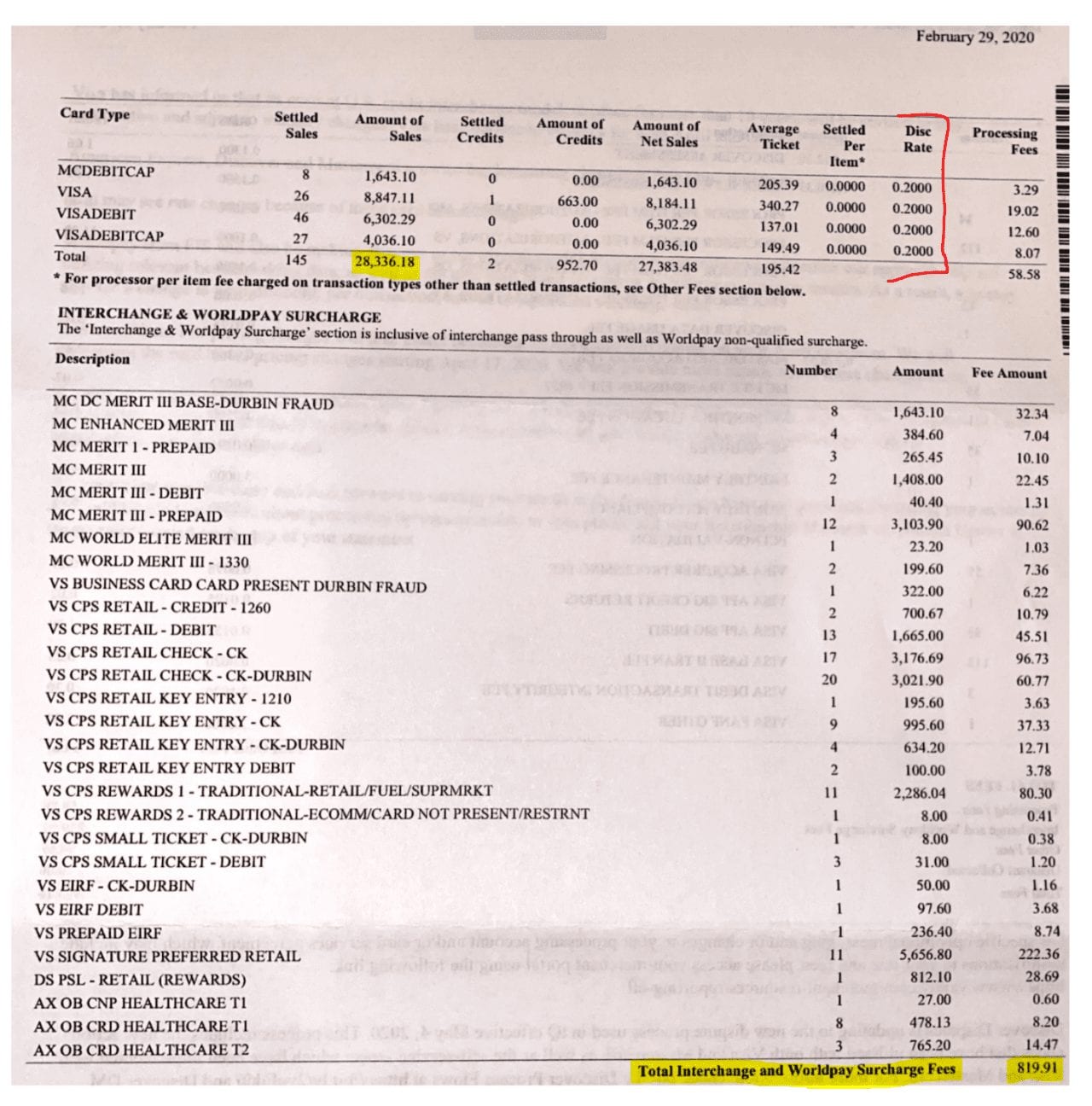

The holdback share is often between 10% and 20% of your day by day receipts and stays fixed until the advance is paid in full. The issue price and subsequent APR is set more by the applicant business’ sales efficiency. Simply, higher revenue numbers can put the applicant in a greater situation with a probably lower issue rate.

A typical issue rate for an MCA may range between double and triple digits relying upon the provider. As a result, they are not topic to the same laws or federal regulations as traditional small business loans, which leaves more room for manipulation. MCAs are regulated by the Uniform Commercial Code as established by every state in the united states, rather than federal banking legal guidelines similar to The Truth in Lending Act. Whilst there are exterior stories of Boost Capital offering money advances of as much as £500,000, it doesn’t explicitly say this, so it is best to get a quote yourself. Furthermore, the quantity of funds on offer may be very depending on both your card sales and month-to-month turnover.

Another option for startups, Fora solely requires six months in enterprise, however has excessive income requirements and an origination fee, not like National Funding. Despite the high APR and revenue necessities, Fora offers up to $500,000 for a service provider cash advance, much higher than other competitors in the merchant advance recreation. Merchant money advances normally come with an origination payment, not so with National Funding. While small enterprise owners will nonetheless face higher rates of interest typical of a merchant advance, National Funding has some one of the decrease thresholds for approval for this kind of business funding.

No comments:

Post a Comment